A decentralized computing platform

ETH price live chart

Download Ethereum wallet app

Store & Transfer ETH safely

Monitor your ETH balance in USD

Receive ETH in ETH, BNB networks

Send Ethereum by mobile phone number with 0% fee

ETH wallet mobile app for iOS and Android

Ethereum basics

Ether

Infrastructure

Ethereum is a distributed blockchain computing platform for smart contracts and decentralized applications. Its native token is ether (ETH), which primarily serves as a means of payment for transaction fees and as collateral for borrowing specific ERC-20 tokens within the decentralized finance (DeFi) sector.

Ethereum token type

ETH

Native

Payments, Work

Ether is used to pay gas fees on every transaction. Once migrated to Eth2, validators will stake the tokens to participate in consensus and receive block rewards.

With the Beacon Chain in production, users can deposit their ETH into the Deposit Contract to claim a validator slot on the Ethereum 2.0 network. Validators have the right to stake ETH on the Beacon Chain to participate in block production and earn staking rewards.

Ethereum history and first price

Crowdsale

Ethereum’s original token distribution event, managed by the Ethereum Foundation, sold roughly 60 million ethers (80% of the initial 72 million ETH supply) to the public. The sale took place between July 22, 2014, and September 02, 2014. However, the Ether purchased by crowdsale investors were not usable or transferable before the launch of the Genesis Block on July 31, 2015. The price of ether was initially set to a discounted price of 2000 ETH per BTC until August 05, 2019, before linearly declining to a final rate of 1337 ETH per BTC, reached on August 28, 2014.

- 3,700 BTC were raised in the first 12 hours of the sale

- Over 25,000 BTC were raised in the first 2 weeks.

- The sale eventually allowed the Ethereum Foundation to raise over 31,000 BTC, equivalent to $18.3 million.

The remaining 12 million ETH (20% of the initial supply) were allocated to the Foundation and early Ethereum contributors. Of the ether sent to the Foundation:

- 3 million were allocated to a long-term endowment

- 6 million were distributed among 85 developers who contributed prior to the crowdsale

- 3 million were designed as a “developer purchase program” which gave Ethereum developers the right to purchase ether at crowdsale prices.

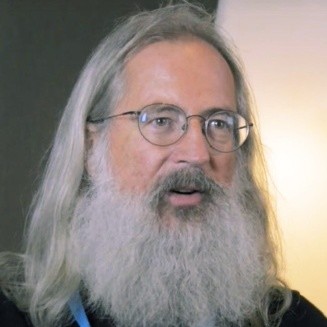

Conception to token sale Vitalik Buterin conceived Ethereum in 2013, after what he perceived as limitations in the functionality of Bitcoin’s scripting language, namely the lack of Turing completeness. Buterin published the first Ethereum white paper later that year, describing a distributed computing platform for executing smart contracts and building decentralized applications (dApps). In 2014, Buterin and some other early contributors founded the Ethereum Foundation, a non-profit organization dedicated to Ethereum’s research, core protocol development, and ecosystem growth. The foundation's first task was to host the Ethereum crowdsale, which raised 31,529 BTC (~$18 million at the time) in exchange for about 60 million ether, and use the proceeds to fund the network's initial development. The Ethereum Foundation continues to be the primary funding organization, issuing grants to research teams and projects focused on Ethereum.

The rise of initial coin offerings (ICOs) Ethereum's mainnet launched in July 2015, with the first live release known as Frontier. Shortly thereafter, Augur (REP) conducted the first Initial Coin Offering (ICO), in which the startup sold its Ethereum-based REP tokens (created via the ERC-20 standard) to help fund the project. The ability to develop and sell a newly generated token to help raise capital became an attractive method of fundraising because projects could circumvent the legal policies and costs required from traditional companies (until more recently). Ethereum-focused startups created thousands of new tokens since Augur's ICO, raising billions of dollars in the process.

The DAO hack In April 2016, a decentralized venture fund known as The DAO hosted an ICO, raising ~$150 million in ETH in the process. A few months later (July 2016), an attacker exploited a bug in one of The DAO's smart contracts, enabling the guilty party to siphon 3.6 million ETH. A significant portion of the Ethereum community opted to revert the chain to remove The DAO and its subsequent hack from the network's history. The remaining stakeholders held the preservation of immutability in higher regard and refused to accept a ledger rewrite. The divide in the community led to a contentious hard fork a few weeks post-hack, causing a permanent split in the network. The legacy chain that did not reverse its transaction history is now known as Ethereum Classic ($ETC).

The path to scalability: Ethereum 2.0 Scalability is a known limitation for the current state of Ethereum. Periods of high user activity, as seen during the CryptoKitties launch in Nov. 2017 and the DeFi bonanza during the Summer of 2020, can cause transaction times and fees to skyrocket, which often prices out retail users and newcomers.

The potential shortcomings of Ethereum's current design are nothing new to Ethereum developers. Various teams have been working since the launch of Ethereum to upgrade the network to account for better scalability and security measures without compromising the community's values of decentralization. The current plan is to swap Ethereum's consensus layer from Proof-of-Work (PoW) to Proof-of-Stake (PoS) and implement a scaling technique known as sharding in a massive upgrade called Serenity (also referred to as Ethereum 2.0).

Ethereum developers have broken down this upgrade into three or more phases to minimize complexity as they add more features. The first phase Phase 0 has a minimum launch date of Dec. 1, 2020. It will bring the Beacon Chain (the backbone of Ethereum 2.0) to life and enable the network to bootstrap a stable of validators to ensure network security. The following phases are being developed in parallel but might take several years before they reach completion.

The launch of Berlin, the second step of the Istanbul upgrade, should occur at some point in 2020. Ethereum core developers split Istanbul into two phases because two of the EIPs up for discussion require extensive testing and development before launch. At the moment, core devs have approved and raised two EIPs to accepted status. There are two other proposed EIPs that may be ready in time for Berlin.

Accepted EIP-2315 implements simple subroutines for the EVM which could lower gas costs and make states analysis easier EIP 2537 (which superseded EIP-1962) implements a single BLS curve to make it easier to deploy and manage rollup contracts and zk-SNARKs/STARKs

Proposed EIP-2046 reduces the gas cost for static calls made to precompiled contracts EIP-2565 will re-price the ModExp precompile (EIP-198) to enable more cost-efficient verification of RSA signatures, verifiable delay functions (VDFs), and primality checks, among other functions

Istanbul Phase II notably excludes any EIPs related to the difficulty bomb (i.e., the Ethereum "ice age"). The core developers concluded, "there's no major reason do it now" because the difficulty bomb is only necessary once Ethereum 2.0 and its Proof-of-Stake (PoS) consensus mechanism are activated. Overlooking an Ice Age EIP for now also prevents any further delays in Berlin's development phase.

Core devs and the greater Ethereum community also excludes the EIP-1057, the proposal for the now-infamous ProgPoW (short for Progressive Proof-of-Work). It aimed to alter Ethereum's hashing algorithm to close the performance efficiency gap between generalized and specialized mining hardware (otherwise known as ASICs). While GPU miners and some core devs favored the proposal, many in the community were vehemently against it. Therefore, all sides agree to a href=" "not include ProgPoW/a in any upcoming forks as no protocol changes are worth triggering a network split

Learn more: Berlin EIPs spreadsheet

EIP-1559 was authored by Vitalik Buterin and Eric Conner, among others. It aims to replace Ethereum's "first-price auction" fee model with a base network fee that could change based on network demand. The goal is to create a more efficient fee market and simplify the gas payment process for client and application software, removing the potential for users to pay unnecessarily high gas fees. EIP-1559 also proposes burning the base network fee to help keep this fee low and ETH inflation in check.

Phase 1 will introduce 64 independent shard chains to the ETH 2.0 network. Shard chains will not execute state or keep track of account balances, as the phase intends to only test the construction and validity of shard chains with the Beacon chain. ETH 1.0 will continue to run in parallel with ETH 2.0 throughout this phase.

A proposal for merging the current Ethereum network with Ethereum 2.0 first introduced by Vitalik Buterin. The proposal intends to remove the Proof-of-Work (PoW) chain by moving everything onto the Beacon Chain on an accelerated schedule. This accelerated merge requires stateless clients on Ethereum 1.x, which would remove the need for most nodes to store the entire state altogether.

The final phase of Serenity will add full-functionality to shard chains, enabling them to execute transactions and maintain account balances. It also introduces the eWASM virtual machine, which will replace the EVM.

Olympic was the final Ethereum proof-of-concept released before mainnet launch. Its stated purpose was to reward participants for testing the limits of the Ethereum design by “spamming the network with transactions and doing crazy things with the state.” The event included a competition that offered a pool of 25,000 ETH (a href=" "~0.03% of Ethereum's initial supply/a) for the top miner and developer participants. Broad testnet engagement unearthed critical bugs and simple optimizations in the live system that the core team was able to identify and resolve pre-mainnet. Ethereum core developers deprecated Olympic when Frontier launched in favor of Mordon, the Frontier-equivalent public testnet.

Frontier marked the official 1.0 release of the Ethereum mainnet and introduced a series of new characteristics, including a block reward, a temporary gas block limit, and Canary contracts. The Frontier launch enabled miners to start receiving real ETH as a reward for their efforts, with the initial block subsidy consisting of five ETH per valid block. Version 1.0 also featured a hardcoded gas limit of 5000 gas per block to prevent any issues with node installation. The gas limit lasted only a few days post-launch before being automatically removed. To avoid unwanted chain forks, Frontier contained Canary contracts as well. Canary contracts gave Ethereum core developers the ability to stop specific operations or transactions before a miner wandered off to an orphaned chain. These contracts meant the final execution of transactions remained centralized in Ethereum's early stages.

Homestead was the first planned hard fork of Ethereum and took place at block number 1,150,000. The upgrade removed the Canary contracts used in Frontier, thus eliminating the centralized process for executing transactions, and introduced the now widely-used Solidity smart contracts. It also included the (now deprecated) Mist wallet, the first user interface (UI) for storing and transacting tokens, as well as writing and deploying smart contracts.

Furthermore, Homestead was one of the first implementations of a href=" "Ethereum Improvement Proposals (EIPs)/a, and the upgrade introduced three new EIPs upon activation: EIP-2 (which included sub-proposals EIPs 2.1-2.4) ensured ACID compliance (all-or-nothing) for contract deployments and helped stabilize block times EIP-7 added the DELETECALL opcode EIP-8 equipped client software with the ability to accommodate future network protocol updates

The Spurious Dragon hard fork activated at block 2,675,000, which arrived on Nov. 22, 2019. The upgrade introduced four code changes: EIP-155 offered protection from replay attacks EIP-160 increase the price of the EXP opcode to make it more challenging to slow down the network with computationally intensive operations EIP-161 makes it possible to remove large numbers of empty accounts to reduced blockchain state size EIP-170 set a limit for the code size a smart contract can contain to prevent repetitive attacks on large pieces of code

Byzantium was the first phase of the proposed Metropolis upgrade and activated at block 4,370,000. The Byzantium hard fork included nine EIPs, with EIP-100, EIP-658, and EIP-649, introducing the most significant code changes. EIP-100 adjusted the difficulty formula to stabilize the ETH issuance rate EIP-658 added a new field to transaction receipts to indicate success or failure EIP-649 delayed the difficulty bomb (i.e., the Ethereum "ice age") by one year and reduced the block subsidy from five to three ETH Details on the remaining Byzantium EIPs are available here.

Constantinople, the second phase of Metropolis, was initially scheduled to go live at block 7,080,000 (January 16, 2019). But on January 15, 2019, security auditing firm ChainSecurity discovered a vulnerability in one of the accepted EIPs that would enable a reentrancy attack (i.e., the opportunity for an attacker to steal user funds similar to The DAO hack). Core Ethereum developers and some projects running on the network voted to delay Constantinople until the developers closed the security loophole.

After a month-long delay, Constantinople and its security patch, St. Petersburg, went live at block 7,280,000, introducing five new code changes to the network: EIP-145 added Bitwise shifting instructions to the EVM, making the execution of shifts in smart contracts significantly cheaper EIP-1052 expedited inter-smart contract verification (smart contract can verify each other via a hash rather than the entire code set) EIP-1014 improved state channel integrations to facilitate the connection to off-chain scaling solutions EIP-1283 reduced costs for executing multiple updates within a single transaction (aka the SSTORE opcode) EIP-1234 delayed the difficulty bomb for another year and reduced the mining reward from three to two ETH per block (the reduction is also known as the "Thirdening")

The first phase of Istanbul is set to activate at block 9,069,000, almost two months after its initially scheduled launch (Oct. 16, 2019). Istanbul Phase I intends to introduce six new EIPs upon activation to help optimize opcode computational costs, improve denial-of-service attack security, and enhance the performance of layer-2 solutions using a href=" "ZK-SNARKs/a or a href=" "ZK-STARKs/a, among other advancements. The accepted EIPs include: EIP-152 adds the ability to verify Zcash-to-Ethereum atomic swaps EIP-1108 reduces the costs for ZK-SNARKs EIP-1344 improves smart contract ability, especially those used by layer-2 solutions, to track the correct base chain during a hard fork EIP-1844 restructures the costs of specific a href=" "Ethereum Virtual Machine (EVM)/a opcodes to deter spamming attacks and to match each operation with its required level of computation EIP-2028 reduces the cost of calling data within transactions and the fees associated with ZK-SNARKs and ZK-STARKs EIP-2200 alters the cost of storage in the EVM and allows smart contracts to generate more creative functions

The Muir Glacier hard fork activated at block 9,200,000, which arrived on Jan. 2, 2020. The upgrade only included EIP-2384, which delayed Ethereum's inherent "Difficulty Bomb" for another 4,000,000 blocks (approximately 611 days) to prevent block times from increasing (and usability plummeting). Muir Glacier's abrupt arrival, less than a month after Istanbul, marked the third time Ethereum core developers opted to delay the Difficulty Bomb (aka Ice Age).

Learn more: Ethereum Muir Glacier Upgrade by the Ethereum Cat Herders

Serenity Phase 0 marks Ethereum's initial transition to Ethereum 2.0. This initial phase will introduce the Beacon Chain, which will serve as the backbone for Ethereum 2.0's sharded network architecture. As opposed to Ethereum's current Proof-of-Work (PoW) blockchain, the Beacon Chain will use Casper FFG, a specific variation of Proof-of-Stake (PoS), and a system of validators to confirm transactions and inhibit Sybil attacks.

Ethereum core developers split the Serenity upgrade into three phases to optimize the development process and limit deployment risks. The specifications for this first phase include: Beacon Chain is the core of the Ethereum 2.0 system; it manages the PoS protocol for itself and all of the individual shard chains. The Beacon chain will use Casper the Friendly Finality Gadget (Casper FFG) to ensure transaction finality. Fork Choice enables validators' clients to automatically select the right chain when the Phase 0 Serenity fork is initiated Deposit Contract allows Ethereum stakeholders to transfer funds from ETH 1.0 to ETH 2.0 and claim rights to a validator role on the new PoS chain Honest Validator dictates the expected behavior of an "honest validator and slashing specifications with respect to Phase 0 of ETH 2.0

It is essential to note the launch of Phase 0 will not immediately replace Ethereum 1.0 (also known as Ethereum 1.x). The two chains will coexist for at least until Serenity Phase 1.5 arrives, which marks when the current Ethereum chain will merge into the Ethereum 2.0 system a shard within the network. Running the legacy and future chains in parallel may cause ETH inflation to increase as both chains will simultaneously mint new tokens.

Ethereum technology explained

Account-based model Ethereum is an account-based blockchain consisting of external accounts, which are controlled by a user’s private keys, and contract accounts, which are managed by contract code. External contracts can create and sign messages to send to both types of accounts, while contract accounts can only execute transactions automatically in response to a message they have received. The latter are what are known as smart contracts and enable the programmability of decentralized applications (dApps).

Ethereum Virtual Machine The heart of the Ethereum blockchain is known as the Ethereum Virtual Machine (EVM), which is the part of the protocol that executes transactions. It is a Turing complete virtual machine featuring a specific language “EVM bytecode,” typically written in a higher-level language called Solidity. Every operation on the EVM requires computational effort and memory. Ethereum node operators and miners provide these scarce resources to application developers and network users in exchange for gas. Different operations require different amounts of gas, and the user can specify how much they are willing to pay in ETH for each unit of gas. The amount of gas required for the transaction, along with the price paid, becomes the transaction cost. Every transaction also had a gas limit to prevent attacks from overloading blocks, which could slow down block production.

Developer tools and token standards Ethereum adopted Ethereum Request for Comment (ERC) 20 in late 2015 as a standard for Ethereum smart contracts to issue tokens on the platform. The majority of tokens built on Ethereum are ERC-20 compliant, meaning they follow a standard set of rules defining how they are created and used. Another more popular token rule set is ERC-721 with standardizes the issuance of non-fungible tokens (NFTs) where any given token is distinguishable from another making them popular for gaming.

Ethereum 2.0 As Ethereum transitions to Eth 2.0, it will undergo significant changes to its design. It will transition from Proof-of-Work to Proof-of-Stake and feature a sharding architecture. Currently, nodes must validate every transaction to maintain an updated global state. The new sharding model segments the network into various groups (called shards) and randomly assigns nodes to each shard. Rather than having to monitor the entire chain, nodes only have to validate their respective shard(s). Individual shards shared their transaction details with the Beacon Chain, which acts as the backbone of Ethereum 2.0. The Beacon Chain serves to validate the transactions on each shard, helping the entire network reach consensus. It also identifies dishonest validators and initiates penalties in the form of slashing, in which a portion of a validator's stake is removed from circulation. Eth 2.0 will also replace the EVM with Ethereum WebAssembly (eWASM), which intends to translate coding logic more efficiently and help improve Ethereum’s scalability.

Ethereum supply limit

Inflationary

Fixed Issuance

Block Rewards, Block Time, Hard Forks and Issuance Rate

New ether are generated via block rewards, initially set at 5 Ether per block. Those block rewards incentivize miners to secure the network. Miners that find an uncle block also receive 87.5% of the base block reward. Uncle blocks occur when several distinct miners simultaneously mine a block. In this case, the block that has the most accumulated PoW is conserved, and others are rejected. Unlike the Bitcoin chain that does not reward miners for orphan blocks, the Ethereum chain does reward uncle block miners. Transaction fees, however, are not awarded to uncle block miners. As Vitalik Buterin notes, the initial intent behind rewarding uncle block miners was to avoid mining centralization caused by the network lag that smaller miners could endure:

"This mechanic was originally introduced to reduce centralization pressures, by reducing the advantage that well-connected miners have over poorly connected miners."

In 2017, the difficulty bomb increased block times drastically, thus reducing the issuance rate. Indeed, the difficulty bomb, also known as "ice age" was initially designed as a mechanism to disincentivize miners to continue mining the Ethereum chain by making it exponentially harder to create a new block. This was meant to accelerate the transition from Proof-of-Work to Proof-of-Stake.

The Casper development and transition to Proof-of-Stake being delayed, Vitalik Buterin and Afri Schoeden proposed to delay the difficulty bomb and reduce the block rewards from 5 Ether to 3 Ether, thus leaving the system in the same general state as before. This proposal, EIP 649, was included in the Byzantium hard fork which was implemented on October 16, 2017, at block 4,370,000, thus effectively reducing block rewards from 5 Ether to 3 Ether and delaying the difficulty bomb for approximately 1.4 years.

On February 28, 2019, at block 7,280,000, the Constantinople hard fork further reduced block rewards from 3 Ether to 2 Ether, and once again delayed the difficulty bomb for approximately 12 months with EIP 1234.

The Ethereum's Parity multi-sig wallet bug

On November 06, 2017, a vulnerability in the "library" smart contract code was exploited by an anonymous user. Subsequently, the user destroyed the library contract. This destruction locked forever a total amount of 513,774.16 Ether located in 587 multi-signatures parity wallets. Messari Proprietary Methodology to calculate liquid supply excludes any non-transferable coins. Thus, these locked Ether are considered illiquid and are not included in our liquid supply calculation.

ETH 2.0 and the transition to Casper Proof-of-Stake

In ETH 2.0, the Ethereum chain will be maintained via a new proof-of-stake system, where rewards will be distributed on a sliding scale based on the total amount staked on the network. The more total supply that’s staked, the higher the system-wide issuance rate (to incentivize high cumulative participation). Although individual yields will decline as the staking participation increases. A table posted by Vitalik Buterin on Github lays out the sliding scale issuance rate.

Justin Drake, a researcher at the Ethereum Foundation, argued that targeting 30,000,000 ETH at stake, long-term, “seems about right for strong security.” It would represent about 30% of the network and result in an approximate 3% annual inflation. Nevertheless, the penalties applied to validators going offline as well as the slashing penalties and the transaction fees burnt due to EIP 1559 will lead to the destruction of Ether, thus reducing the total net issuance amount.

The transition to Proof-of-Stake will occur in three or four stages, according to the latest specifications shared by the core developers:

- Phase 0, expected for Dec. 1, 2020, will initially increase issuance compared to the current level. This is due to the fact that both the Proof-of-Work and Beacon Chain will run simultaneously and rewards will be distributed on both chains, although the staking participation, and thus annual issuance on the Beacon Chain, will most likely be very low during this Phase.

- Phase 1, expected for Q4 2021, will allow finalizing the Proof-of-Work chain with Proof-of-Stake. The Proof-of-Work rewards will most likely be reduced to match an issuance rate between 0.5% and 1% (versus 4.5% before Phase 1). Both Proof-of-Work and Proof-of-Stake rewards will co-exist and the global issuance rate should be around 1% at that stage.

- Phase 1.5, estimated for 2022, will mark when Ethereum 2.0 transfers will likely unlock, giving stakers access to their previously inaccessible staked ETH and accumulated rewards. These rewards and staking amounts will date back to the launch of the Beacon Chain.

- Phase 2, estimated for 2023, will progressively lead to an increase of staking participation, thus increasing the annual issuance rate, while Proof-of-Work will simultaneously progressively disappear.

Ethereum consensus

Proof-of-Work

0.25 min

Modified GHOST protocol The Ethereum White Paper states Ethereum uses a modified version of the "Greedy Heaviest Observed Subtree" (GHOST) protocol to distinguish the "longest" base chain (the chain with the most accumulated Proof-of-Work backing it) from forks. Nakamoto Consensus, the implementation used by Bitcoin ($BTC) and its forks, is problematic in networks with fast confirmation times (i.e., block times) like Ethereum. Quick block times lead to a higher stale or orphan rate, which can split mining resources among competing forks and reduce overall network security. Accelerated confirmation times also increases the likelihood a single mining pool could obtain a majority of the hashpower on a given chain.

The GHOST protocol attempts to solve this issue of network security by including orphan blocks in the calculation of the longest chain. Therefore, the GHOST model determines the valid chain by weighing the parent and further ancestors as well as the number of stale descendants. The protocol also rewards the mining of orphan blocks directly connected to the longest chain to combat potential centralization concerns. Orphan block miners do not receive any transaction fees, only a portion of the block subsidy, as stale transactions are not considered valid.

Some say GHOST works better in theory than in practice, claiming Ethereum further modified its consensus implementation before (or soon after) launch to avoid security complications. Others suggest the Ethereum consensus model better resembles Nakamoto consensus or a modified version of the Inclusive protocol. But the inclusion of EIP-100 in the Byzantium fork changed Ethereum's difficulty calculation algorithm to include orphan blocks, which indicates the proposed modified GHOST implementation is intact. Regardless of the security model classification, Ethereum continues to reward orphan block miners with 87.5% of the base block reward.

Mining Ethereum miners solve computational puzzles to generate new blocks by running the Ethash Proof-of-Work (PoW) algorithm. In this process, miners compete to discover a valid hash, using the Keccak-256 and Keccak-512 hash functions, as defined by Ethereum's difficulty adjustment algorithm. Unlike Bitcoin's biweekly adjustments, Ethereum recalculates its difficulty level every block based on the time between the two previous blocks.

Cryptographers designed Ethash to be ASIC-resistant by making it memory intensive for specialized mining chips. But the popularity of Ethereum led mining chip manufacturer Bitmain to release the first ASICs miners for Ethash in April 2018. The majority of the Ethereum remains opposed to ASIC miners, as evidenced by its support for the ProgPoW EIP (a likely inclusion in the second Istanbul hard fork). Ethereum also plans to transition to a Proof-of-Stake (PoS) consensus model, which would render any mining equipment obsolete.

Ethereum governance

No On-Chain Governance

Ethereum operates similarly to Bitcoin through off-chain, informal governance. In this model, developers can submit protocol upgrades, dubbed Ethereum Improvement Proposals (EIPs), on Ethereum's open-source GitHub repository. Core Ethereum developers then discuss new proposals, with additional input from the extended community. If approved by a majority vote, core developers merge the changes into the base code. To avoid complications post-merge, node operators must update their clients to the latest software.

Who regulate Ethereum in 2026?

On June 14, 2018, the U.S. SEC's Director of Corporate Finance, William Hinman, revealed that the SEC does not consider ether (ETH) to be a security.

"Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions."

SEC Chairman Jay Clayton later confirmed Hinman's analysis on Mar. 12, 2019, stating ether and similar cryptocurrencies do not fall under securities law. Clayton carried on to say that the Howey test framework, the test used by the SEC to determine if certain transactions qualify as "investment contracts," is not static. Therefore, digital tokens first defined as securities can shift to non-securities over time, depending on how they are managed and exchanged.

U.S. Commodities and Futures Trading Commission (CFTC) chairman Heath Tarbert echoed the SEC's findings in Oct. 2019, adding that he views ether as a commodity.

“We've been very clear on bitcoin: bitcoin is a commodity. We haven't said anything about ether—until now. It is my view as chairman of the CFTC that ether is a commodity.”

While ether in its current state is not a security, U.S. regulators have not commented on the legality of Ethereum's crowdsale. But Chairman Clayton did mention that most initial coin offerings (ICOs) look like unregistered securities sales.

Store Ethereum with Cropty cryptocurrency wallet by 3 simple steps:

- Download the app from the Apple AppStore or Google Play, or open your browser wallet.

- Create your Cropty wallet account with Face ID or Touch ID security options.

- Transfer ETH from external wallet.

Receive Ethereum to your Cropty wallet by QR-code, phone number, e-mail and nickname:

- Download the app from the Apple AppStore or Google Play, or open your browser wallet.

- Create your Cropty wallet account, set up a nickname.

- Click ‘Receive’ and follow the instructions.

You can transfer your Ethereum holdings and store it safely with Cropty wallet. Cropty secures safety of your holdings through various verification options like using password, authenticator app, Face ID, Touch ID and backup codes. You can be sure no one can get access to you Ethereum holding except you.

Start investing in Ethereum with Cropty cryptocurrency wallet by 3 simple steps:

- Download the app from the Apple AppStore or Google Play, or open your browser wallet.

- Create your Cropty wallet account, set your authentication settings.

- Transfer ETH from external wallet.

The Cropty wallet provides the most convenient application for storing and transfering Ethereum. Cropty targets to become one the best crypto wallets for Android and iOS in 2026. Cropty provides convenient application and secure custodial services, built for crypto beginners, as well as for crypto-savvies.

You can receive Ethereum donations instantly with Cropty wallet. Download Android or iOS app or open the web version, sign up, click ‘Receive’ and follow simple instructions. Share your address with someone who wants to donate you in crypto.

You can receive Ethereum donations instantly with Cropty wallet. Download Android or iOS app or open the web version, sign up, click ‘Receive’ and follow simple instructions. Share your address with someone who wants to donate you in crypto.

You can send Ethereum instantly without fee in the Cropty wallet. Download Android or iOS app or open the web version, sign up, click ‘Send’, choose ‘Send via e-mail, phone number or nickname’ and follow simple instructions.

- Sign up to Ethereum wallet.

- Top up your balance with Ethereum.

- Store, trade or deposit your Ethereum.

- Get Ethereum deposit interest directly to your Cropty wallet.